All shoppers face end-of-month battles – but we’ve got a secret interest-free shopping weapon to help you bust your budget woes. By the end of this article, you’ll be a certified shopping ninja and personal finances pro!

What is interest-free shopping?

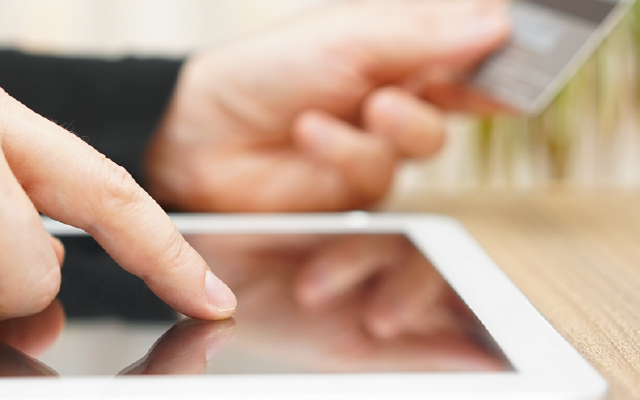

Put simply, interest-free shopping is the convenient product of Buy Now, Pay Later (also known as BNPL) platforms. Unlike your credit card, which allows you to make purchases upfront but demands hefty interest fees, BNPL allows you to buy products upfront without the interest fees.

Okay – how does BNPL work?

Normally, BNPL platforms ask for a portion of the full price of a product upfront and the rest can be paid in a series of interest-free payments over a fixed period of time. The repayments are generally the same amount, and you’ll be notified upfront about how much they’ll be. BNPL offers full transparency!

The pros of interest-free shopping with BNPL

BPNL is fast becoming a popular alternative to credit card plans. The transparency of BNPL platforms empowers you to plan your purchases with clear oversight.

Interest-free shopping also slashes the interest fees that you would normally pay on a credit card, easing the month-end squeeze on your poor wallet.

By far the most significant pro of BNPL is the convenience. You can buy what you need immediately and pay for it in a way that you can afford. No costly interest fees, and no catch. This is super useful when it comes to buying more expensive items!

That’s music to the ears of young millennial and Gen-Z professionals. Gone are the days when you had to wait until your next pay check before furnishing your empty apartment with a badly-needed couch. With BNPL, you can purchase the items that you need right now without burying yourself under a mountain of accrued interest debt.

Interest-free shopping habits will also help you finesse your personal finances. BNPL platforms typically come with a built-in payment plan so, unlike a credit card, you cannot carry a balance indefinitely. This is a savvy way to exercise financial discipline and avoid going into the kind of debt usually associated with credit cards.

Conclusion

With BNPL platforms like Payflex, you can buy what you need right now without burying yourself under hectic interest fees. Plus, we’ll let you pay off your purchases in six interest-free instalments. So, the next time your apartment needs an extreme home makeover, use interest-free shopping to give yourself more time to purchase the things you need.

You can read more about what we have to say about BNPL and avoiding credit card debt!