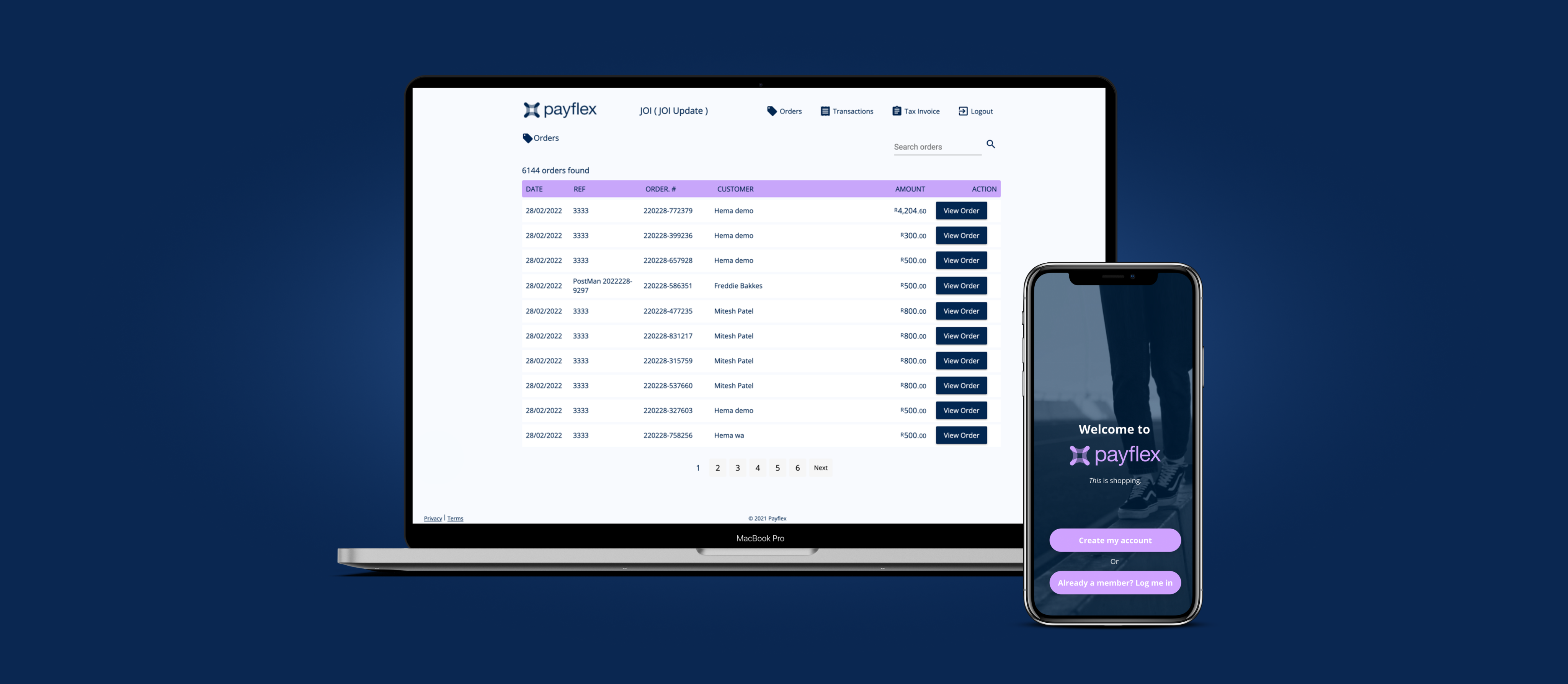

A buy now, pay later payment solution for online or in-store merchants.

Get PayflexGive your customers a flexible payment option and see your sales increase. Payflex is a payment solution available for online and in-store purchases. We provide your shoppers with flexible funding, paying you upfront but giving them 6 weeks OR 3 paydays to pay – interest free!

We take the risk. You take all the rewards. We pay you. They pay us. We handle all support

Get Payflex

Please let us know which solution you require.

APPLY FOR PAYFLEX ONLINE AND IN-STORE

Please complete this form to apply for

Payflex Online and In-Store.

Online or in-store, we’ve got you covered.

Whether you sell products or services online or in-store, our payment solution has been designed to facilitate payments for both eCommerce and brick and mortor store types.

We can seamlessly integrate our payment gateway into your online store, or enable shoppers to pay via the Payflex app in-store.

Effortless integration

If you are looking to go online with Payflex, we’ve got great news. We already integrate with many leading eCommerce platforms which makes getting started easy and fuss-free.

Not a ‘plug and play’ type? Our ‘by developers for developers restful API’ allows you to easily control your own online integration and add the payment gateway.

Our payment products

Payflex offers two payment products that can be integrated online or in-store. You can offer your shoppers one or the other or even better, both. We offer simple, transaprent pricing and don’t charge your for setting up Payflex online or in-store. You’ll only pay a nominal monthly service fee, and transaction fees on successful orders.

Pay Later

We give your shoppers the ultimate in payment flexibility by allowing them to buy now and pay later at 0% interest.

What does that mean for you? It means more sales, higher average order values and an increase in return shoppers!

Pay Now

Shoppers can also choose to pay now in full via Payflex. We offer a safe, secure card payment solution that settles with merchants every business day of the year unless requested otherwise.

Merchants who use us as their one and only online card payment solution have had huge success, and very happy customers.

Great for your shoppers.

Even better for your business.

Increase

sales

Increase sales by 30% by giving shoppers 6 weeks OR 3 paydays to pay with our Pay Later product.

Boost

Cashflow

Competitive buy now pay later rates, coupled with swift settlements, will boost your cash flow — all with superior service.

Grow your

customer base

We’ll drive our tens of thousands of Payflex users to your store through marketing initiatives.

Exceptional service

and support

You’ll receive a dedicated Payflex account manager and your customers get the best support team in the business.