The BNPL Gold Rush: Investors dash to buy equity in Buy Now Pay Later Players

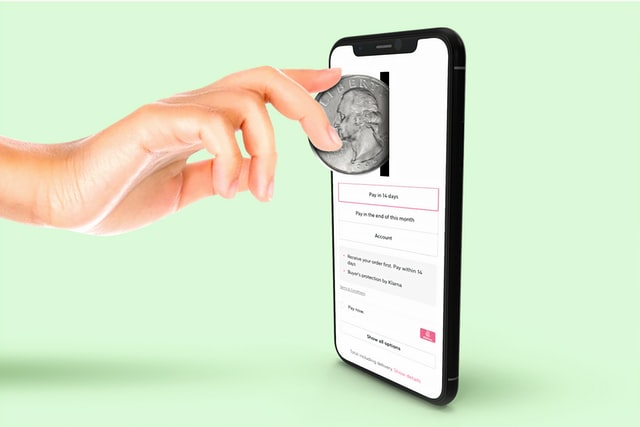

A string of high-profile acquisitions is spurring the buy now pay later (BNPL) sector to enter its next phase of growth. These acquisitions are expected to push BNPL into the mainstream, establishing it as the payment option of choice.

In recent months, various payments and tech leaders have been clamouring to buy equity stakes in buy now pay later solutions across the globe. Last month, Chinese Tech Giant Tencent acquired a $250 Million Stake in Afterpay. While in March, Chinese payments giant Ant Financial bought a stake in Swedish fintech start-up Klarna. And this month, New Zealand’s Zip Payments, which has a 25% stake in South African BNPL payment fintech, Payflex, announced it is acquiring American buy now pay later player Quadpay.

But, what are the reasons behind this recent flurry of acquisitions? Derek Cikes, Commercial Director of Payflex, attributes this surge in demand to the COVID-19 pandemic and resultant change in consumer shopping habits.

BNPL surge driven by change in consumer shopping habits

“The shift from offline to online due to COVID-19 has been significant. As a payment solution with over 200 eCommerce merchants using our platform, we have seen substantial growth in the online retail environment,” Says Cikes.

He explains that merchants are seeking effective payment methods to prevent cart abandonment and boost conversion rates during and beyond the pandemic. This caters to consumers who want to spread their payments with an interest-free payment plan rather than expensive credit.

As the COVID-19 pandemic pushed more and more people online, Australia’s Afterpay had more than 15 million app and site visits in April.

He says with eCommerce set to be a key lifeline for the retail sector while it tries to piece itself back together, retailers need to offer alternative payment solutions such as BNPL, mobile payments and digital wallets that better meet the needs of consumers who are financially stressed and better informed than ever on the cost of using credit solutions.

“The rapidly evolving payments landscape means eCommerce retailers need to offer a mix of payment methods to consumers at checkout that help remove barriers to purchase and increase the chances of online ‘window shoppers’ converting into buyers.”

“We have seen the BNPL solution effectively boosting sales by 30%. In addition, the Payflex 1-click checkout process can reduce cart abandonment by a whopping 40% – a huge benefit for eCommerce merchants in the current economic climate,” says Cikes.

Responsible, debt-free shopping

Cikes says with rising unemployment rates and increasing concerns about the economy, factors like credit card fees and interest are pushing consumers to demand more flexible payment options.

A decrease in credit card transactions highlights the need for alternative BNPL payment plans. In March, Visa reported that payment volumes were down 4 percent from 2019. While a recent report by Global Web Index echoes this trend, finding 83% of consumers think brands should be providing flexible payment solutions.

“Millennials and Gen Z had a reputation for being debt averse prior to the outbreak of the COVID-19 pandemic. The virus is expected to further entrench this mindset. And this means a rising number of consumers are expected to gravitate towards merchants offering flexibility. This year, millennials have a combined spending power of $1.4 trillion. And, with 90% avoiding credit products by choice due to cost and risks, many are turning to BNPL options as a better way to budget for the items they want.”

BNPL Market Growth

The buy now pay later market is set to grow significantly. A new report by Worldpay from FIS forecasts that BNPL services will steadily gain eCommerce market share ultimately earning nearly 3% of global eCommerce spend by 2023.

“South Africa is seeing evidence of this trend. There has been a substantial uptake of BNPL options. This is because budget-conscious consumers look to ease their financial constraints and make their money go further,” concludes Cikes.

It seems that for any eCommerce store or marketplace, having a BNPL payment option isn’t a question of if they should implement it, but when.